Profit and loss forecasting is an essential tool that helps businesses navigate the complexities of financial planning and decision-making. By accurately predicting future revenues and expenses, companies can position themselves for growth and sustainability, ensuring they meet their financial goals.

This forecasting process involves analyzing past performance, understanding market trends, and creating detailed profit and loss statements that allow businesses to make informed choices about budgeting, investments, and strategic initiatives.

Profit and Loss Forecasting Basics

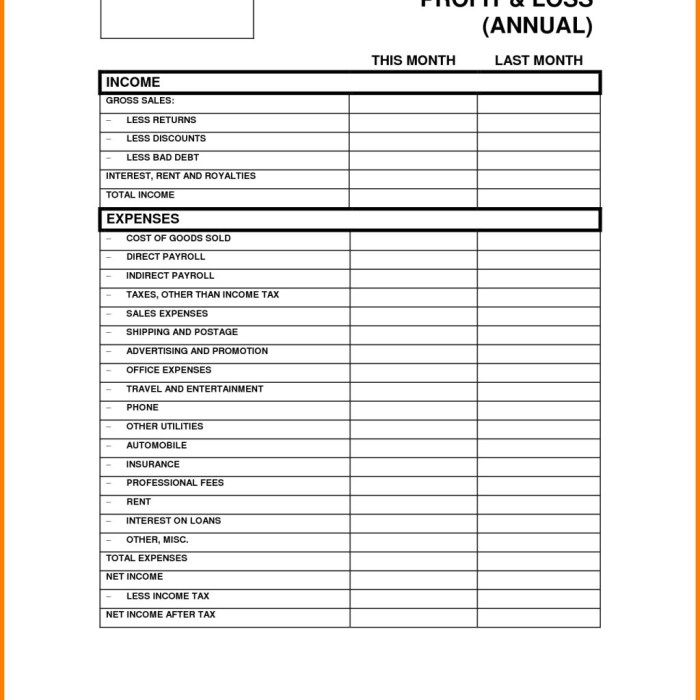

Profit and loss forecasting is an essential aspect of financial management for businesses. It involves estimating future revenues and expenses to determine a company’s profitability over a specific period. Understanding these fundamentals helps organizations make informed decisions that can significantly impact their financial health.The primary components of a profit and loss statement include revenues, cost of goods sold (COGS), gross profit, operating expenses, and net income.

Revenues are the total income generated from sales, while COGS represents the direct costs associated with producing goods sold. Gross profit is calculated by subtracting COGS from revenues. Operating expenses encompass all other costs necessary to run the business, and net income is the final profit after all expenses are deducted.To estimate revenues and expenses, businesses can use various methods, such as historical data analysis, market trends, and industry benchmarks.

This analytical approach allows companies to create more accurate forecasts, consider different scenarios, and adjust their strategies accordingly.

Importance in Business Accounting

Profit and loss forecasting plays a crucial role in business accounting practices. Accurate forecasting directly impacts financial reporting, as it provides a roadmap for expected financial performance. This information is vital for stakeholders, including investors and management, to assess the company’s financial stability and growth potential.Furthermore, there is a strong relationship between profit forecasts and budgeting processes. Effective forecasting helps businesses allocate resources efficiently, ensuring that expenditures align with projected revenues.

This alignment is essential for maintaining healthy cash flow and achieving financial goals.

Integration with Payroll Accounting

Profit and loss forecasting significantly influences payroll budgeting within organizations. Forecasting allows businesses to align payroll costs with overall profitability projections, ensuring that staffing levels and compensation packages are sustainable in relation to expected revenues.Methods for aligning payroll costs include analyzing historical payroll expenses against revenue forecasts and adjusting staff hours or salaries based on predicted profitability. Employee compensation plays a vital role in forecasting, as retaining skilled employees often involves competitive salaries and benefits.

Role in Business Advertising Strategies

Advertising budget decisions can be effectively guided by profit and loss forecasts. By understanding potential profitability, businesses can allocate funds to advertising channels that yield the highest return on investment (ROI). Adjustments to advertising spending can be based on profitability predictions, allowing companies to boost marketing efforts during profitable periods and scale back when forecasts indicate potential losses. Measuring ROI for advertising campaigns involves comparing increased sales to the cost of advertising, providing insight into the effectiveness of marketing strategies.

Impact on Business Agriculture

Profit and loss forecasting is particularly relevant in the agricultural sector, where external factors such as weather conditions and market demand can significantly impact profits. Agricultural forecasting models must consider these variables to provide realistic projections.Successful agricultural businesses often utilize profit forecasts to make informed decisions about crop selection, resource allocation, and market timing. Case studies show that farms employing strategic forecasting can optimize yields and enhance financial stability.

Application in Architecture and Interior Design

In architecture and interior design, profit and loss forecasting is fundamental for project pricing. Accurate forecasting of expenses helps firms estimate the financial viability of projects and set competitive pricing structures.Methodologies for forecasting expenses in design projects include analyzing past project costs, estimating material and labor expenses, and considering market rates. Design choices also impact profitability; therefore, balancing creative vision with cost considerations is crucial for financial success.

Influence on Business Branding Decisions

Profit forecasts can significantly shape branding and marketing strategies. Understanding the financial implications of branding investments allows businesses to make informed decisions that enhance profit margins.Investments in branding can have varying impacts on profitability. Companies must carefully assess how brand messaging aligns with financial goals to ensure sustainable growth and market relevance.

Connection with Business Travel Expenses

Managing business travel budgets can benefit from profit and loss forecasting. By incorporating travel costs into profit forecasts, businesses can make informed decisions about travel expenditures that align with profitability goals.Strategies for optimizing travel expenditures include setting clear budgets, using technology to track spending, and evaluating the necessity of travel against potential benefits. This financial oversight can enhance overall profitability.

Relevance in Career Advice

Understanding profit and loss forecasting is essential for career development, particularly in finance and management roles. Professionals equipped with forecasting skills are often more competitive in the job market.Resources to enhance forecasting skills include online courses, financial modeling workshops, and mentorship programs. Job roles where these skills are critical include financial analysts, accountants, and business consultants.

Significance in Change Management

Profit and loss forecasting can greatly support change management initiatives. Organizations undergoing transitions can assess the financial impacts of changes, ensuring that strategies are financially sound.Methods for assessing financial impacts during organizational changes include scenario analysis and sensitivity testing. Effective change management supported by financial forecasting often leads to smoother transitions and better financial outcomes.

Importance in the Construction Industry

In construction project management, profit and loss forecasting is vital. It aids in estimating costs accurately for construction bids, ensuring that projects remain profitable throughout their lifecycle.Key metrics for monitoring profitability in construction projects include gross profit margin, cost variance, and project completion rates. By regularly reviewing these metrics, firms can adjust their strategies to enhance financial performance.

Use in Business Consulting

Consultants can utilize profit and loss forecasting to conduct thorough client assessments. Presenting financial forecasts to clients involves breaking down complex data into understandable insights that inform strategic planning.Forecasting in business consulting helps identify growth opportunities, potential risks, and resource allocation strategies, making it an integral part of the consulting process.

Planning for Continuity and Disaster Recovery

Profit and loss forecasting plays a crucial role in disaster recovery planning. Businesses can assess financial risks and prepare forecasts for recovery scenarios to ensure continuity during challenging times.Best practices for maintaining continuity through financial foresight include developing contingency plans, regularly updating forecasts, and monitoring external factors that may impact financial stability.

Enhancing Customer Service Operations

Profit and loss forecasting can drive improvements in customer service operations. By understanding the financial impact of customer satisfaction, businesses can justify investments in service enhancements.Aligning customer service goals with financial targets can result in better resource allocation and improved financial performance, creating a win-win situation for both customers and the organization.

Contributions to Entrepreneurialism

For startups, profit and loss forecasting is invaluable. Entrepreneurs can use forecasting to attract investors by demonstrating a clear understanding of potential profitability and financial viability.Evaluating business viability through financial forecasts allows startups to make informed decisions about growth strategies, product development, and market opportunities.

Ethical Considerations in Business Forecasting

The ethical implications of profit and loss forecasting practices are significant. Transparency in financial reporting is crucial for maintaining stakeholder trust and long-term success.Businesses must avoid potential pitfalls in unethical forecasting behavior, such as manipulating data to present a more favorable picture of financial performance. Upholding ethical standards ensures credibility and fosters sustainable growth.

Benefits of Business Franchising

Profit and loss forecasting impacts franchising decisions, guiding franchisees in understanding the financial potential of their business models. Accurate forecasting is crucial for establishing realistic expectations and operational plans.Examples of franchise models benefiting from accurate forecasting include food franchises that adjust inventory and staffing based on projected sales. Insights about franchisee profitability and support systems can enhance the overall success of the franchise network.

Managing Furnishings and Supplies Costs

Profit and loss forecasting can optimize inventory management for furnishings. Accurate forecasting methods help businesses predict supply costs effectively and manage inventory levels.The impact of supplier relationships on profitability predictions cannot be underestimated; strong partnerships with suppliers can lead to better pricing and terms, enhancing overall financial performance.

Role in Human Resources Management

In human resources management, profit and loss forecasting guides budget planning for HR initiatives. By aligning HR strategies with financial performance goals, organizations can ensure effective resource allocation.The impact of workforce costs on overall profitability is significant, necessitating careful consideration of hiring practices, training investments, and employee development programs.

Applications in Industrial Mechanics

Profit and loss forecasting affects investment decisions in the industrial mechanical sector. Understanding the relationship between machinery costs and profitability forecasts enables informed capital investment decisions.Case studies of industrial companies utilizing forecasting for strategic planning illustrate its importance in enhancing operational efficiency and maximizing return on investment.

Ultimate Conclusion

In conclusion, mastering profit and loss forecasting equips businesses with critical insights that drive effective financial management and strategic planning. By embracing these practices, companies can enhance their operational efficiency and achieve lasting success in their respective markets.

Essential Questionnaire

What is profit and loss forecasting?

It is the process of predicting future profits and losses based on historical data, market conditions, and business plans.

Why is profit and loss forecasting important?

It helps businesses make informed financial decisions, plan budgets, and assess their overall financial health.

How often should profit and loss forecasts be updated?

They should be reviewed and updated regularly, ideally quarterly or biannually, to reflect changes in the market and business conditions.

Can small businesses benefit from profit and loss forecasting?

Absolutely! Small businesses can gain valuable insights into their operations and make better financial decisions by using forecasting.

What tools can assist with profit and loss forecasting?

There are various software tools and templates available, including spreadsheets and dedicated financial planning software that can streamline the forecasting process.